OSSD中的普通年金

2020-06-24 环球教育

大家好,今天我们来聊一下OSSD11年级初等函数中普通年金的概念。

When people invest, they usually do not simply deposit one lump sum and wait several years for it to earn interest. Most wise investors make regular payments (that are payments of equal value made at equal time periods), often deducted directly from their paycheques. Investments of this type are called annuities. An annuity is a sum of money paid as a series of regular payments. For an ordinary annuity, each payment is made at the end of each payment period, or payment interval. A payment interval is the time between successive payments. The word annuity implies annual or yearly payments, however, payment intervals may be any length of time.

当人们投资时,他们通常不会简单地一次存一笔钱,然后等上几年才能赚取利息。大多数明智的投资者定期付款(即在同一时间段支付同等价值的款项),通常直接从他们的工资支票中扣除。这种类型的投资称为年金。年金是作为一系列定期付款而支付的一笔钱。对于普通年金,每次支付都是在每个支付期或支付间隔结束时进行的。付款间隔是连续付款之间的时间。“年金”一词意味着每年或每年的支付,然而,支付间隔可以是任何时间长度。

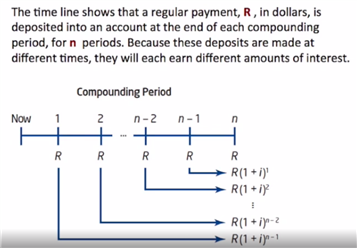

Time line

Time line is a diagram used to illustrate the cash flow of an annuity.

时间线是用来说明年金现金流的图表。

The total amount, A, at the time of the last payment of an annuity can be determined using the formula:

A=R(1+i)n-1i

这个公式通常写为 FV=R(1+i)n-1i,用于定期向银行存钱,然后求出到期后获得的钱。其中FV是future value即到期后从银行获得的钱,i代表利率,R代表定期向银行存的钱。(这个公式中PV为0)

Present Value of an Ordinary Annuity

Anna and Jimi are approaching retirement and are putting their finances in order. They have worked hard and invested their earnings so that they now have a large amount of money on which to live. They consult a financial advisor at their bank, and together they consider whether Anna and Jimi have enough money to allow them to live comfortably for the rest of their lives by making regular withdrawals from an account. To do this they calculate the present value of an annuity based on Anna and Jimi’s projected living expenses.

The amount of money invested now for an ordinary annuity is the present value of the annuity. The annuity provides equal payments at the end of each equal time interval. The present value can be calculated for a known interest rate, compounding period, number of payments, and amount of each payment.

安娜和吉米快要退休了,他们正在整理财务。他们努力工作,把收入投入到生活中,现在有了一大笔钱。他们向银行的财务顾问咨询,一起考虑安娜和吉米是否有足够的钱,通过定期从一个账户中取款,让他们能够舒适地度过余生。为此,他们根据安娜和吉米的预计生活费用计算年金的现值。

现在投资于普通年金的金额是年金的现值。年金在每个相等的时间间隔结束时提供相等的支付。现值可以根据已知的利率、复利期、付款次数和每次付款的金额计算。

You will recall the amount is based on the interest rate per compounding period, for example:

Saving $100 per month for five years = $6,000 + interest, whereas

Saving $100 per week for five years = $26,000 + interest.

In the previous learning activity, problems were posed in which regular payments are made into an account that grows to a large future amount.

In this learning activity, problems will be posted in which regular withdrawals will be made from an account that begins with a large balance.

The formula for the present value of an annuity:

PV=R1-(1+i)-ni

这个公式用于每期想从银行取到定额的钱,然后求出一开始需要在银行存多少钱。其中PV代表present value即一开始在银行存的钱,i代表利率,R代表每期在银行取的钱。(这个公式中FV为0)

环球教育秉持教育成就未来的理念,专注于为中国学子提供优质的出国语言培训及配套服务。环球教育在教学中采用“九步闭环法”,帮助学生快速提升学习效能,同时提供优质的课后服务,跟进学生学习进程,为优质教学提供坚强的保障。目前,环球教育北京学校已构建了包含语言培训、出国咨询、国际课程、游学考察、课程等在内的一站式服务教育生态圈。相关问题可免费咨询http://beijing.gedu.org,或拨打免费热线400-616-8800~

北京市海淀区环球雅思培训学校 版权所有 课程咨询热线:400-616-8800

Copyright 1997 – 2026 gedu.org. All Rights Reserved 京ICP备10036718号

全部课程、服务及教材面向18岁以上人群

市场合作申请