OSSD函数-单利和复利

2020-06-15 环球教育

大家好,今天我们来聊一下OSSD11年级初等函数中单利和复利的概念。

Simple Interest/单利

You have just won a lottery. What would you do with a Million Dollars? Consider putting it into the bank. The bank will allow you to earn interest on your money. One type of account is called a simple interest account which is the simplest form of interest.

你刚刚中了彩票一百万美元你会怎么办?考虑把它放进银行。银行将允许你从钱中赚取利息。一种账户叫做单利息账户,这是最简单的利息形式。

Simple Interest is calculated using the formula I = Prt, where:

我们可以使用公式I=Prt计算简单利息,其中:

I is the interest

P is the principal amount of money you put into the account (that is the amount of money initially invested or borrowed)

R is the annual rate of interest that you get (that is the rate at which interest is charged, as a percent (expressed as a decimal for calculations), per year)

T is the time that the money is in the account (and is measured in years).

I是利息

P是存入账户的本金(即最初投资或借款的金额)

R是每年获得的利率(即收取利息的利率,以百分比(表示为小数点进行计算)表示)

T是资金进入账户的时间(以年为单位)

When you take out a loan, you are the borrower and you pay interest. When you deposit money at a financial institution, the bank is the borrower and you earn interest.

At the end of the lending period, the amount, A, repaid by the borrower to the lender is the sum of the principal and the interest.

当你贷款时,你是借款人,你支付利息。当你在金融机构存款时,银行是借款人,你赚取利息。

在贷款期结束时,借款人向贷款人偿还的金额A是本金和利息的总和。

A = P + I

While simple interest is rarely used in bank accounts and loans today, it is important to understand its fundamental nature before learning the more advanced concepts to be introduced in the next learning activity.

虽然目前银行账户和贷款很少使用单利,但在学习下一次学习活动中引入的更先进概念之前,了解其基本性质是很重要的。

Compound Interest/复利

In the last learning activity, we invested $1,000,000 in a simple interest account. With simple interest, we get the interest only on the initial principal. The more common practice is to calculate interest on the total amount we have in our account at the time the interest is calculated. After the first time period, we will get the interest on our interest.

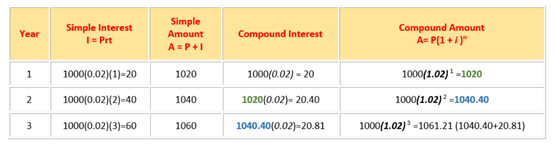

Let's look at the investment of $1000 at 2%/a simple interest and 2%/a compounded annually for three years:

在上一次学习活动中,我们向一个利息账户投资了1000000美元。对于单利息,我们只得到初始本金的利息。更常见的做法是计算利息时,我们在账户中的总金额的利息。在第一个时期之后,我们将从我们的利息中获得利息。

让我们看看1000美元的投资,按2%/年单利和2%/年复利计算,为期三年:

Using compound interest, in year 2 we make interest on the $1020, (the principal plus year 1 interest). In year 3 we make interest on the $1040.40, (the principal plus year 1 and year 2 interest) and so on.

Comparing values in both types of accounts at year 3:

Simple Interest Account = $1,060.00

Compound Interest Account = $1,061.21

We are going to make an extra $1.21 just because we got interest on our interest.

使用复利时,在第二年我们对1020美元(本金加上第一年利息)计息。在第三年,我们对1040.40美元(本金加上第一年和第二年的利息)计息,以此类推。

比较第三年两类账户的价值:

单利账户=1060.00美元

复利账户=1061.21美元

我们要多赚1.21美元,因为我们从利息中获得利息。

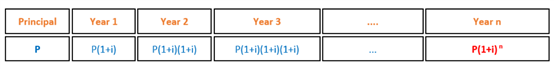

Now let's look closer at the method used to derive compound interest:

现在让我们更仔细地看一下用来计算复利的方法;

This generates a geometric sequence with a=P(1+i) and r=(1+i). This would give us tn=P1+in.

The interest that is added to the principal before the new interest earned is calculated. So interest is calculated on the principal and on interest already earned. Interest is paid at regular time intervals called the compounding period.

在计算新获得的利息之前加在本金上的利息。所以利息是根据本金和已经赚取的利息计算的。利息按固定的时间间隔支付,称为复利期。

In Compound Interest, the Amount is calculated using the formula A=P(1+i)n, where:

在复利中,金额是用公式A=P(1+i)n计算的,其中:

I is the interest rate per compounding period (changed into a decimal).

P is the principal amount of money you invest or borrowed.

A is the amount you end up with or owe.

N is the number of compounding periods.

I是每个复利期的利率(改为小数)。

P是你投资或借款的本金。

A是你最终拥有或欠下的金额。

环球教育秉持教育成就未来的理念,专注于为中国学子提供优质的出国语言培训及配套服务。环球教育在教学中采用“九步闭环法”,帮助学生快速提升学习效能,同时提供优质的课后服务,跟进学生学习进程,为优质教学提供坚强的保障。目前,环球教育北京学校已构建了包含语言培训、出国咨询、国际课程、游学考察、课程等在内的一站式服务教育生态圈。相关问题可免费咨询http://beijing.gedu.org,或拨打免费热线400-616-8800~

北京市海淀区环球雅思培训学校 版权所有 课程咨询热线:400-616-8800

Copyright 1997 – 2026 gedu.org. All Rights Reserved 京ICP备10036718号

全部课程、服务及教材面向18岁以上人群

市场合作申请